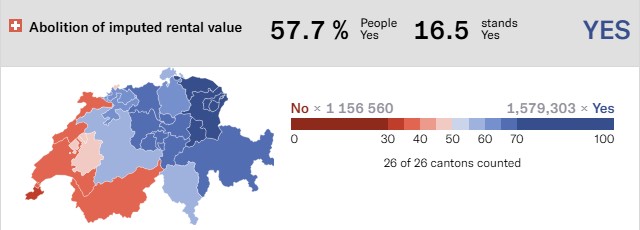

Switzerland is famous for precision, order, and sometimes… eccentricity. Yesterday, on 28 September 2025, voters finally pulled the plug on one of the quirkiest features of the Swiss tax system: the Eigenmietwert. After decades of debate, 57.7% of Swiss voters said yes to abolishing the so-called “imputed rental value” on self-occupied homes.

So, what exactly did the Swiss just vote out of existence — and why does it matter to you, especially if you’re an expat living here?

What on earth is the Eigenmietwert?

Imagine this: you live in your own home, but the tax office pretends you are renting it out to …… yourself. Wait, what? I’m taxed on rent I don’t actually earn?? Exactly. You live in your own house, no rent, no landlord. And yet, the tax office insists on treating you as if you were your own tenant. You’d then “earn” a notional rent (the imputed rental value), which is added to your taxable income. In return, you may deduct mortgage interest, maintenance, renovations, and related costs. That is the Swiss “Eigenmietwert” system in a nutshell.

Sounds bizarre? It is. But there was logic behind it: the tax was designed to keep things fair between renters and owners, since renters can’t deduct their rent. If homeowners weren’t taxed on their “rental income,” owning a house might get too favorable treatment. It also became a steady source of tax revenue.

The imputed rental value has existed in various forms for many decades in Switzerland (some argue since early 20th century), evolving canton by canton. It became entrenched in Swiss tax law long ago as part of the way property and income taxes evolved in different cantons.

Switzerland has clung to this idea for over 90 years, long after most countries abandoned it. The UK, for example, had a similar “Schedule A” tax but abolished it in the 1960s.

So yes, the Swiss system has been relatively exceptional in staying with a nationwide imputed rental value tax for so long.

Impacf of the Eigenmietwert before the reform

Here’s how the Eigenmietwert system played out under the old regime:

| Person / Type of Property | What they paid / got taxed on | What they could deduct | Net effect / challenges |

|---|---|---|---|

| Homeowners (self-occupied) | Imputed rental value added to income | Mortgage interest, maintenance, renovation, insurance, some management costs | If you had low debt, the fictional “rent” often outweighed deductions. Many middle-class owners felt squeezed. |

| Owners of rental property (tenanted) | Actual rental income taxed | Mortgage interest, operating costs, depreciation, etc. | Worked like typical property taxation. No imputed rent applied. |

| Tenants | You pay rent, but don’t get imputed income taxed | You can’t deduct rent. | Indirectly disadvantaged since owners coul offest costs: part of the political argument was that tenants don’t benefit from the reform (unless municipalities raise rent or taxes). |

| Owners of a second home / vacation property | The imputed rental value also applied (for self-use) | Deductions similar to self-occupied case | Often heavily taxed, particularly in tourist regions. |

| Municipalities / Cantons / State | Received revenue from imputed rent taxation | — | The imputed rent system was a source of reliable tax revenue. |

In effect, the system forced homeowners to treat their own home as if it were an income-producing asset — often a theoretical burden that didn’t match cash reality.

What changes with the abolition of Eigenmietwert?

To understand the consequences of the abolition, let’s see how different groups are affected under the new regime:

| Person / Type of Property | What they pay / taxed on | What they can deduct | Net effect / challenges |

|---|---|---|---|

| Homeowners (self-occupied) | No more imputed rental value on income | No deduction for mortgage interest or most maintenance costs (except possible limited energy/heritage deductions in some cantons) | Big relief for low- or no-debt owners, but a disadvantage for highly indebted households, since interest is now a pure cost. |

| Owners of rental property (tenanted) | Actual rental income taxed (unchanged) | Continue to deduct mortgage interest, operating costs, depreciation, etc. | Essentially unchanged — rental property remains taxed like a normal investment asset. |

| Tenants | Still pay rent (unchanged) | Still cannot deduct rent | No direct change. Indirectly, may face higher local taxes if municipalities replace lost revenue elsewhere. |

| Owners of a second home / vacation property | No imputed rental value anymore | No deductions for mortgage interest or maintenance (unless canton allows limited ones) | Cantons may introduce new object taxes on second homes; net effect depends on local implementation. |

| Municipalities / Cantons / State | Loss of federal/cantonal income from imputed rent | — | Need to adjust budgets. Some will use new powers to levy second-home taxes or adjust other local tax instruments. |

Winners, losers, and what changes now

With the Eigenmietwert gone, the rules of the game shift dramatically. Homeowners will no longer be taxed on a fictional rental income. But in return, they will also lose the generous deductions for mortgage interest and maintenance.

Who benefits most? Those with little or no mortgage. For them, the Eigenmietwert often outweighed any deductions, so its abolition will feel like a relief. The less debt you carry, the bigger the win.

Who stands to lose? Highly leveraged homeowners. If you’re paying tens of thousands of francs in interest every year, you’ll no longer be able to deduct that from your income. Suddenly, debt becomes what it always was in reality: a pure cost, not a tax strategy.

Landlords, on the other hand, see little change. They were never subject to Eigenmietwert in the first place; they pay tax on actual rental income and can still deduct expenses. Renters also won’t notice a direct difference, though some fear that cantons looking to replace lost revenue might find ways to raise taxes elsewhere.

The big wild card is second homes. Holiday chalets and lakeside apartments will no longer be taxed on imputed rental value — but cantons now have the power to introduce new object taxes on such properties. Whether that turns into a mild fee or a hefty burden will depend entirely on local politics.

When does it all kick in?

Not tomorrow. The earliest the new rules could realistically take effect is 2028. Until then, the Eigenmietwert system remains in place, and some cantons have already promised to freeze increases during the transition.

What should you do as an expat homeowner?

The new system flips incentives. Under the old rules, it often made sense to keep a bigger mortgage for the tax deduction. Under the new rules, the opposite is true: amortising debt becomes more attractive, because interest payments no longer bring tax relief.

If you’re planning renovations, consider timing. Today, maintenance costs can still be deducted; after 2028, most won’t be. And if you own a vacation property, keep a close eye on your canton — local authorities now hold the pen on whether new second-home taxes will appear.

Finally, if you’re an expat, remember that these changes could also affect your cross-border tax situation. Double taxation treaties, foreign filings, and Swiss reforms often intersect in surprising ways. A conversation with a tax advisor who understands both systems is money well spent.

This change is structural and intersects with international taxation, so don’t wing it.

A final toast to the Eigenmietwert

The abolition of the Eigenmietwert is a watershed moment in Swiss property taxation. It dismantles a long-standing Swiss quirk — taxing homeowners on phantom rent — and forces a rebalancing of who bears what tax burden. Some will gain, some will lose, but the biggest winner may be simplicity — fewer forms, fewer receipts, fewer disputes with the tax office.

For many homeowners — especially those with moderate to low debt — the reform will lighten the load. But if interest rates rise or debt is high, the shift could pinch. The trade-off for second-home owners injects uncertainty: will new local taxes fill the revenue hole?

For expats, landlords, and renters, the change is indirect but real. The landscape is shifting; now is the time to plan strategically, review your financial and tax exposure, and stay dialed into canton-level developments.

Yours,

Helvetia Happenings

✨ At Helvetia Happenings, we translate Swiss complexity into clarity for expats. Explore more of our guides on taxes, housing, and everyday Swiss life — because the little details can make your new life here a lot smoother.